Blockchain technology went main stream last year. This year, large enterprises are going full throttle to develop new systems using the DLT technology, file patent, and implement it for making their business more efficient. The financial sector has taken a considerable lead in using blockchain technology, compared with other heavy industries.

Blockchain technology went main stream last year. This year, large enterprises are going full throttle to develop new systems using the DLT technology, file patent, and implement it for making their business more efficient. The financial sector has taken a considerable lead in using blockchain technology, compared with other heavy industries.

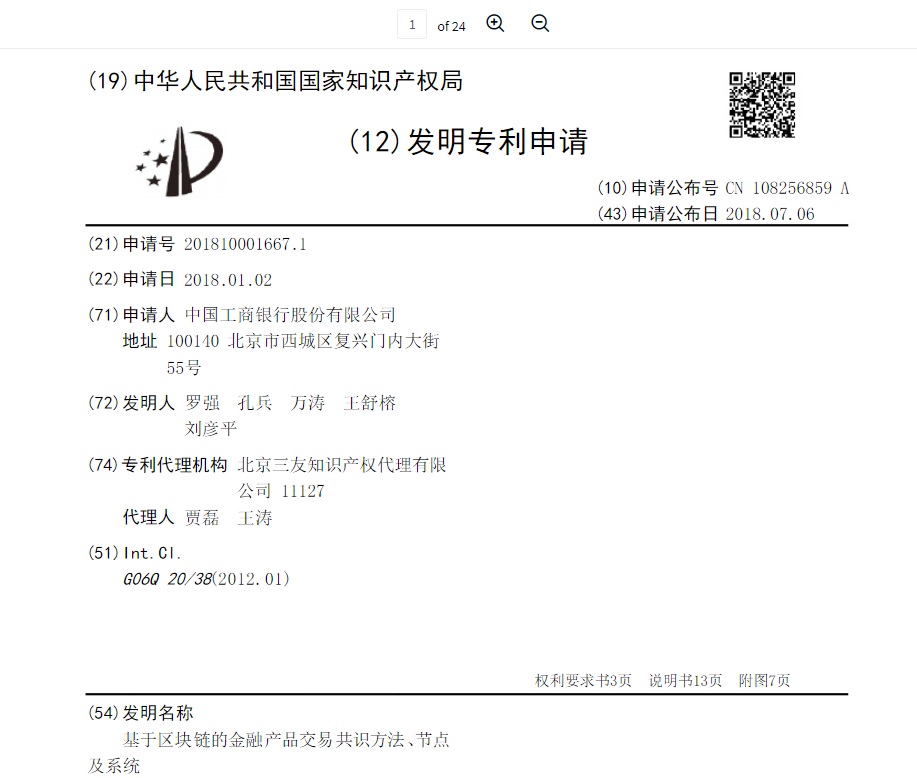

The latest one to file a patent is the Industrial and Commercial Bank of China (ICBC), the largest bank in the world by total assets. ICBC, one among the “Big Four” China government owned banks, has filed a patent application for a blockchain system for the exchange of financial assets.

The application, filed back in January, but revealed last Friday, describes a platform where participating financial institutions will function as nodes and create a distributed network.

The system works as follows. The moment a transaction request is initiated by a user from one institution, a smart contract is triggered. This causes all the available nodes to validate the transaction using the information provided, including the transaction amount, sender’s name and account balance. Once the network receives sufficient validations from the participating nodes, the transaction is deemed to be complete.

The aim of the system is to eliminate intermediates in the existing system and at the same time improve the liquidity of financial assets.

The ICBC has acknowledged in the filing that the prevailing system is slow and expensive while performing cross-border or interbank transactions, involving both normal payments and financial instruments (derivatives). The inefficiencies encouraged ICBC to work on an alternative based on blockchain technology.

The patent states

“The traditional transaction chain that is built around a centralized credibility system incurs problems like the high cost, low efficiency, low stability, as well as inflexibility. This impedes the bank’s launch-to-market process to meet the rapidly growing demand for innovative financial products.”

According to the China State Intellectual Property Office, the patent application filed by the bank is the latest one pertaining to blockchain technology. Notably the bank has recently filed a patent for a system which can verify user information over a distributed network.