Cryptocurrency portfolio tracker Coincall has published a list of shitcoins to raise awareness among the cryptocurrency investors. Coincall has pointed out that the recent ICO scams had tarnished the image of cryptocurrencies, while making it difficult even for genuine projects to raise funds.

Cryptocurrency portfolio tracker Coincall has published a list of shitcoins to raise awareness among the cryptocurrency investors. Coincall has pointed out that the recent ICO scams had tarnished the image of cryptocurrencies, while making it difficult even for genuine projects to raise funds.

Coincall has mentioned that in 2017 alone, $1.30 billion was raised by ICOs. Many overnight operators use the system to prey on the greed of investors. The firm believes that it is a must to discuss about the scams that is deep rooted in the industry. Lack of regulations around ICOs, ignorance, and greed continue to hamper the growth of the disruptive distributed ledger technology that can bring about a big improvement to the world economy.

List of Shitcoins

Coincall has published the initial list of Shitcoins. They are:

- Bitcoin Cash

- Tether

- Bitcoin Diamond

- Veritaseum

- BitConnect

- Davorcoin

- Regalcoin

- Centra

- Plexcoin

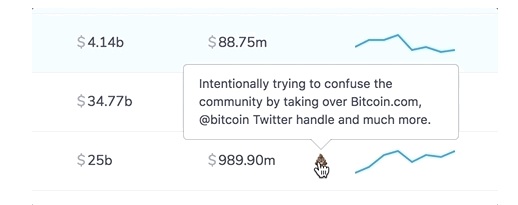

The crypto portfolio tracker would continue to add more cryptos to the list of Shitcoins. The coins are marked by a “poo” emoji. To those who try to counter the Shitcoin list with the argument that some of the cryptos command a large market capitalization, Coincall has explained these coins will have a value of ‘zero’ if everybody toes the same line. Coincall has elaborated the reasons behind their judgment. The reason could be a news published on a news site, medium blog post, or well-known publication that has clearly provided reasons for calling the ICO a scam.

Coincall has also stated that they use straightforward, old-school reasoning for validating a cryptocurrency. Coincall says “If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck.” The marketcap of all the Shitcoins put together is $29.46 billion, at the time of writing this article. To understand the perspective, in April 2017, the market cap of shady ICOs was just $100 million.

This means the growth of cryptocurrency market has drawn a lot of scammers as there is a less chance of getting caught and punished by law enforcement agencies.

Coincall has used Bitcoin Cash as an example to explain the methodology adopted to list a cryptocurrency as a Shitcoin. The portfolio tracker says there is nothing wrong in forking Bitcoin network to create an altcoin that focuses on lower transaction fees. However, “the problem with Bitcoin Cash is that its main supporters continuously try to usurp Bitcoin’s name and thus confuse new users.”

Coincall further stated

“First, they’ve turned the Bitcoin.com website, which serves as a popular starting point for many newcomers, into a full-blown Bitcoin Cash promotion engine. Then they’ve purchased the @Bitcoin Twitter handle. Again, they turned it into a Bitcoin Cash propaganda tool (it has since been suspended by Twitter). The list of similar shady dealings goes all and on.”

Coincall has suggested investors to start evaluating fundamentals and avoid being carried away by empty promises. The website is planning to introduce more tools that will assist investors make better judgments.