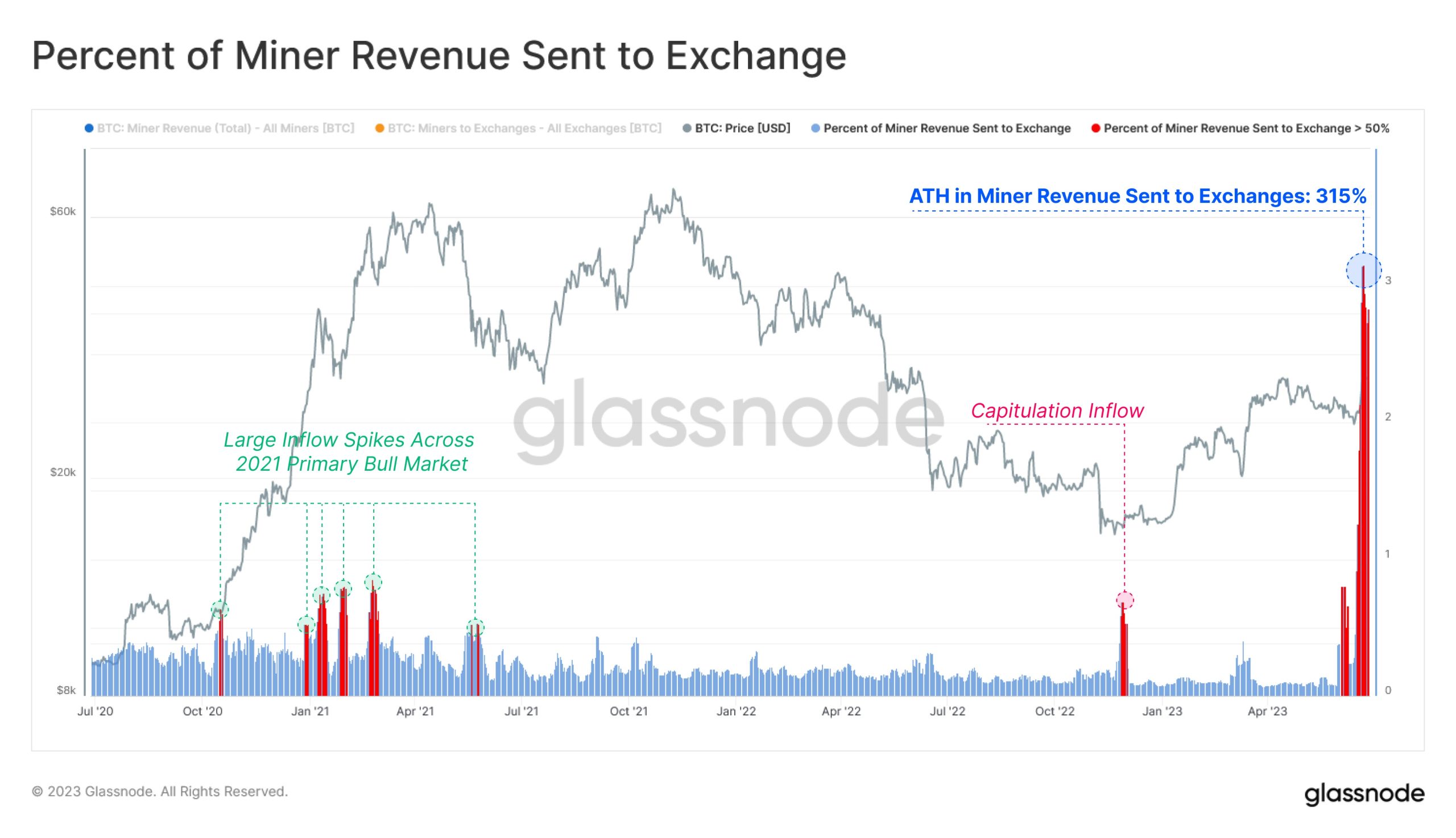

According to the on-chain analytics platform Glassnode, there has been a notable increase in Bitcoin miners sending BTC to centralized cryptocurrency exchanges, reaching an unprecedented level. The platform recently disclosed an exceptionally substantial exchange interaction, with miners successfully transferring an unprecedented amount of $128 million to various exchanges within a week. This figure signifies a significant increase, amounting to 315% of their daily revenue, underscoring the magnitude of this surge.

According to the on-chain analytics platform Glassnode, there has been a notable increase in Bitcoin miners sending BTC to centralized cryptocurrency exchanges, reaching an unprecedented level. The platform recently disclosed an exceptionally substantial exchange interaction, with miners successfully transferring an unprecedented amount of $128 million to various exchanges within a week. This figure signifies a significant increase, amounting to 315% of their daily revenue, underscoring the magnitude of this surge.

During the 2021 bull market, there were intermittent surges in miner revenue being directed toward exchanges to capitalize on profits. Furthermore, a significant surge was observed at the end of 2022, coinciding with the market cycle bottom. However, the current surge surpasses these prior occurrences by a considerable margin.

In practice, miners commonly transfer their Bitcoin (BTC) profits to cryptocurrency exchanges to manage expenses and safeguard accumulated profits. In the previous week, a favorable window emerged for such transactions as Bitcoin (BTC) reached its peak price for the year, reaching $31,185 on June 24th. Ki Young Ju, the esteemed co-founder, and CEO of CryptoQuant, endorses this perspective, affirming that the existing price-to-earnings ratio presents a compelling opportunity for miners to engage in selling activities.

Despite these advancements, Bitcoin prices have not experienced substantial impact thus far, with the asset hovering slightly above the $30,000 mark. It is important to acknowledge that the $31,000 price range presents a notable resistance level for BTC. Previous attempts to surpass this threshold in mid-April and late June were unsuccessful. If bulls fail to establish new territory, potential losses may be anticipated, especially if miners commence liquidating their holdings.

Bitcoin mining profitability, as indicated by the hash rate, has observed a modest upturn in the previous week due to the upward trajectory of BTC prices. According to HashrateIndex, the current profitability is estimated at $0.076 per terahash per day. Despite Bitcoin’s significant year-to-date surge of over 88% in price, miners still face numerous challenges. Profitability has declined by over 30% since July of the previous year and has plummeted by over 80% since reaching its peak during the bullish market of 2021.

With near-record hash rates reaching 377 EH/s and corresponding peak difficulty levels, Bitcoin miners face a formidable challenge. Rising hash rates, increasing difficulty levels, and escalating energy expenses collectively contribute to a decline in mining profitability. Consequently, miners may find themselves obligated to sell their diligently acquired Bitcoin to meet financial obligations, despite this being an unwelcome requirement.