The amount of Ethereum coins held in liquid staking derivatives systems has exceeded seven million, as per statistics from Defillama. The entire worth of assets held on these sites is roughly $12 billion at present. Ninety-five percent of the industry is controlled by the three leading liquid staking platforms.

The amount of Ethereum coins held in liquid staking derivatives systems has exceeded seven million, as per statistics from Defillama. The entire worth of assets held on these sites is roughly $12 billion at present. Ninety-five percent of the industry is controlled by the three leading liquid staking platforms.

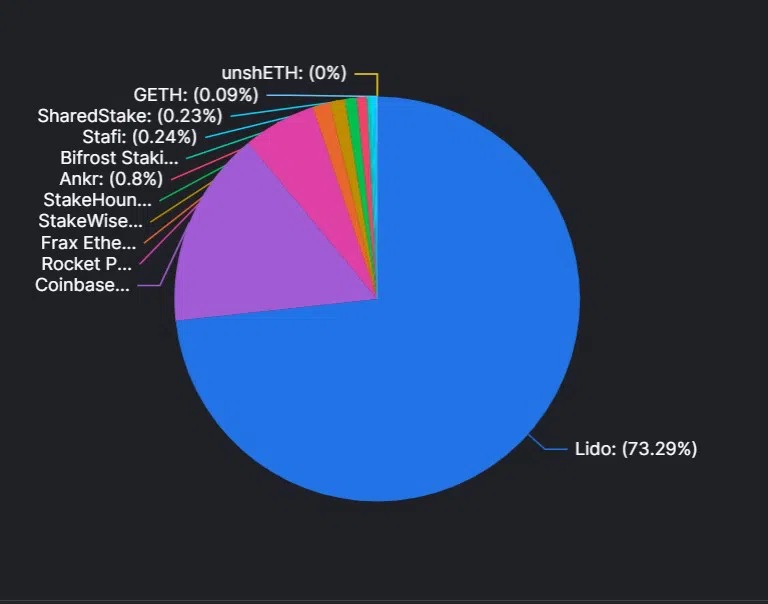

Lido is the largest participant, controlling over 70% of the secured ETH and possessing more than 5 million ETH worth $8.7 billion. Coinbase follows in second with 1.1 million pledged ETH, while DeFi networks RocketPool and Frax Ether collectively have around 500,000 ETH committed on their platforms.

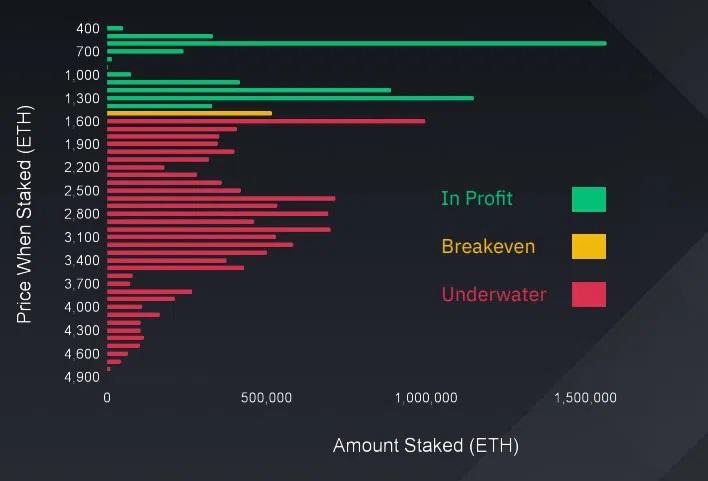

Even though Ethereum developers stated that they would favour committed ETH transfers in the Shanghai update, the quantity of secured ETH on sites has increased. Furthermore, the US Securities and Exchange Commission’s accusations against the Kraken cryptocurrency platform have increased the appeal of liquid mining methods to investors. The increased ETH trading action over the last few months has not, nevertheless, resulted in investment gains. Even though over 16 million ETH units have been pledged, the majority of active speculators are in the red.

As per Binance Research, approximately 69% of ETH speculators are in the red because they pledged their holdings when ETH traded above $1,600. Approximately 2 million ETH were pledged when the digital currency traded between $400 and $700 in December 2020, according to Binance.

Even though liquid staking was not as widespread at the time, these stakers are probably worthless. Binance notes that this group consists of “some of the most ardent Ethereum supporters,” indicating they are unlikely to sell once transfers are enabled.

In spite of these obstacles, the value of Ethereum has grown by 42% year-to-date. While preparing this report, the second-largest cryptocurrency by market capitalization has rallied 11.8% over the past week and 2% over the past 24 hours to trade at $1,693.

As per statistics from ultrasound.money, Ethereum’s availability has been declining since making a move to a proof-of-stake (PoS) network, with its stock having decreased by more than 28,000 ETH.