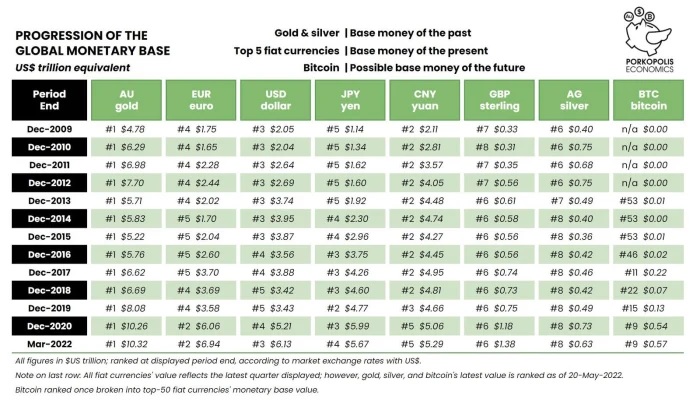

Matthew Meinskis has published another update about the global monetary base. Bitcoin was ranked as the ninth biggest base money in the world as of the end of the first quarter of 2022. (including gold and silver). After the third quarter of 2021, bitcoin was the seventh biggest base money in the world, and its price was at an all-time high. This is two positions lower than it was after that quarter. After dropping by around 25 percent from that all-time high by the end of March 2021, a fall back down the list shouldn’t come as much of a surprise. If the price of bitcoin stays over $27,100 between now and June 30, 2022, the emerging asset should continue to maintain its position on these charts at the ninth slot. In the event that it goes lower than that price (as of the day the article was released, which was May 20, 2022), the Australian cuckbuck will take its place.

Matthew Meinskis has published another update about the global monetary base. Bitcoin was ranked as the ninth biggest base money in the world as of the end of the first quarter of 2022. (including gold and silver). After the third quarter of 2021, bitcoin was the seventh biggest base money in the world, and its price was at an all-time high. This is two positions lower than it was after that quarter. After dropping by around 25 percent from that all-time high by the end of March 2021, a fall back down the list shouldn’t come as much of a surprise. If the price of bitcoin stays over $27,100 between now and June 30, 2022, the emerging asset should continue to maintain its position on these charts at the ninth slot. In the event that it goes lower than that price (as of the day the article was released, which was May 20, 2022), the Australian cuckbuck will take its place.

Bitcoin is in a very strong position when compared to the major basic currencies of the globe, notwithstanding the recent price dips that it has seen. It continues to maintain its position in third place, after the Swiss franc and the British pound. It’s possible that a lot of people will exploit the fact that bitcoin has dropped farther down the list as a “gotcha!” moment to support their preconceived notions that bitcoin will never become the reserve currency of the world. If you take a second look at the chart that is located at the top of this article, you will see that this is not an unusual occurrence for the currency that is expected to become the world’s reserve currency in the future. It quickly ascends the list by many orders of magnitude, but then it levels out for a short while.

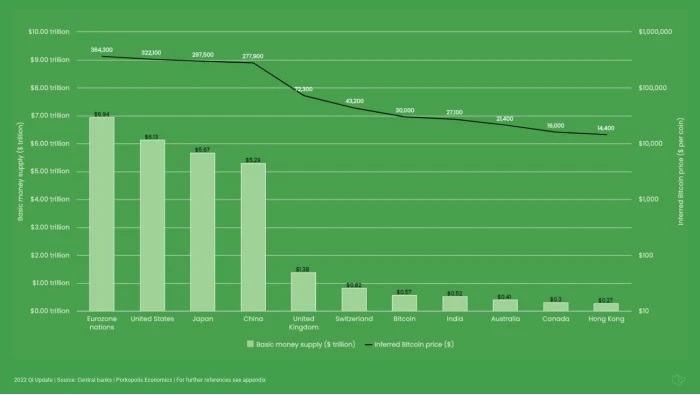

If you take a look at the chart that is located above, you will see that the price of bitcoin is just one or two orders of magnitude away from being the most widely used form of base money on the whole globe. It is quickly moving closer and closer to the top five in the pack, which dominates the pareto distribution of global base currencies. An extraterrestrial monetary technology that was introduced to humans a little more than 13 years ago has accomplished something that is really remarkable.

Alternate methods exist for visualizing the changes in magnitude that result from bitcoin transactions. I have no doubt that the term “decoupling” has been brought up in conversation on more than one occasion. Many people believe that there will come a day in the not too distant future when equity markets will “decouple” totally from bitcoin and the cryptocurrency will no longer trade in lockstep with the asset class. The fact of the matter is that bitcoin has been uncoupled from equity markets for some time now.

Yes, bitcoin may be highly correlated to stocks and other assets over a short or medium time horizon; however, as you can see from the chart showing the ratio of BTC to NASDAQ that was shared by Tuur Demeester above, bitcoin makes massive, orders of magnitude jumps in very short periods of time during massive rallies. Since the procedure was first introduced in 2009, it has also maintained the pattern of repeatedly shifting to the right and moving upward.

Narrator: the decoupling started long ago. Most people don't realize it yet. https://t.co/vz1njEAJxS

— Marty Bent (@MartyBent) May 30, 2022

You can anticipate that this trend will continue if there is an increase in the demand for an extremely scarce monetary bearer asset that can be self-custodied with a reasonable amount of ease and that can be transferred and secured by a globally distributed network of nodes running open-source software. If you consider everything that is occurring in the world today, in particular the attempts by governments to restrict liberties as they lose control of the monetary, food, and energy systems, betting that the demand for bitcoin will not only increase but also increase significantly seems like a bet with a very low risk associated with it.